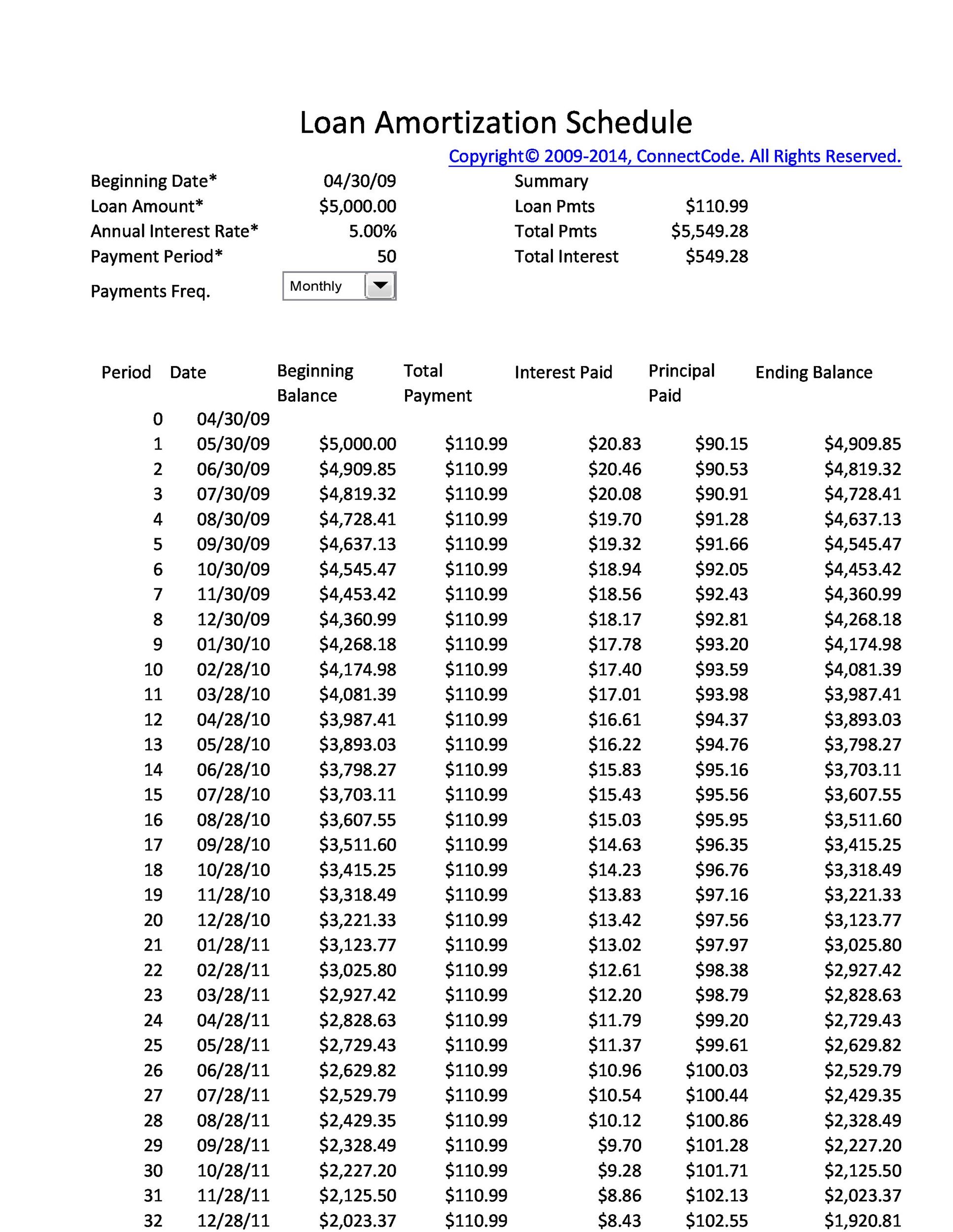

If you take out a fixed-rate mortgage, you’ll repay the loan in equal installments, but nonetheless, the amount that goes towards the principal and the amount that goes towards interest will differ each time you make a payment. Over the course of the loan term, the portion that you pay towards principal and interest will vary according to an amortization schedule.

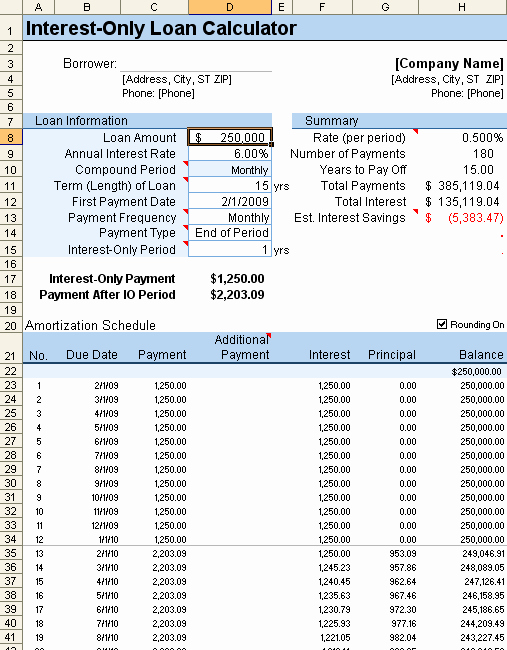

This chart was created using the ARM Calculator spreadsheet.Each month, your mortgage payment goes towards paying off the amount you borrowed, plus interest, in addition to homeowners insurance and property taxes. The red and blue lines represent the interest and principal portions of that payment, respectively. You'll see in the chart below for a 3/1 ARM that the total payment due starts increasing each year after the initial 3-year fixed period. This is particularly useful when looking at an adjustable rate mortgage (ARM). Principal Payment ChartĪnother useful amortization chart shows the interest vs. This technique is not as compatible with other spreadsheet software, though. It involves creating dynamic named ranges and using the named ranges for the series in the chart. However, it is more complicated, and designed to make it hard to figure out what is going on. There is another trick which I use in a lot of my mortgage calculators.

You'll see how this works if you take a look at the Period column in the template.

0 kommentar(er)

0 kommentar(er)